Understanding the Hidden Forces Behind Inflation

Inflation is more than just rising prices at the grocery store; it’s a complex economic phenomenon influenced by a multitude of factors. Understanding these forces is crucial for making informed financial decisions and anticipating future economic shifts. From global supply chain disruptions to government policies, many hidden currents contribute to the inflation trends we observe.

Key Takeaways:

- Inflation is driven by a complex interplay of factors, including supply chain issues, demand surges, and government policies.

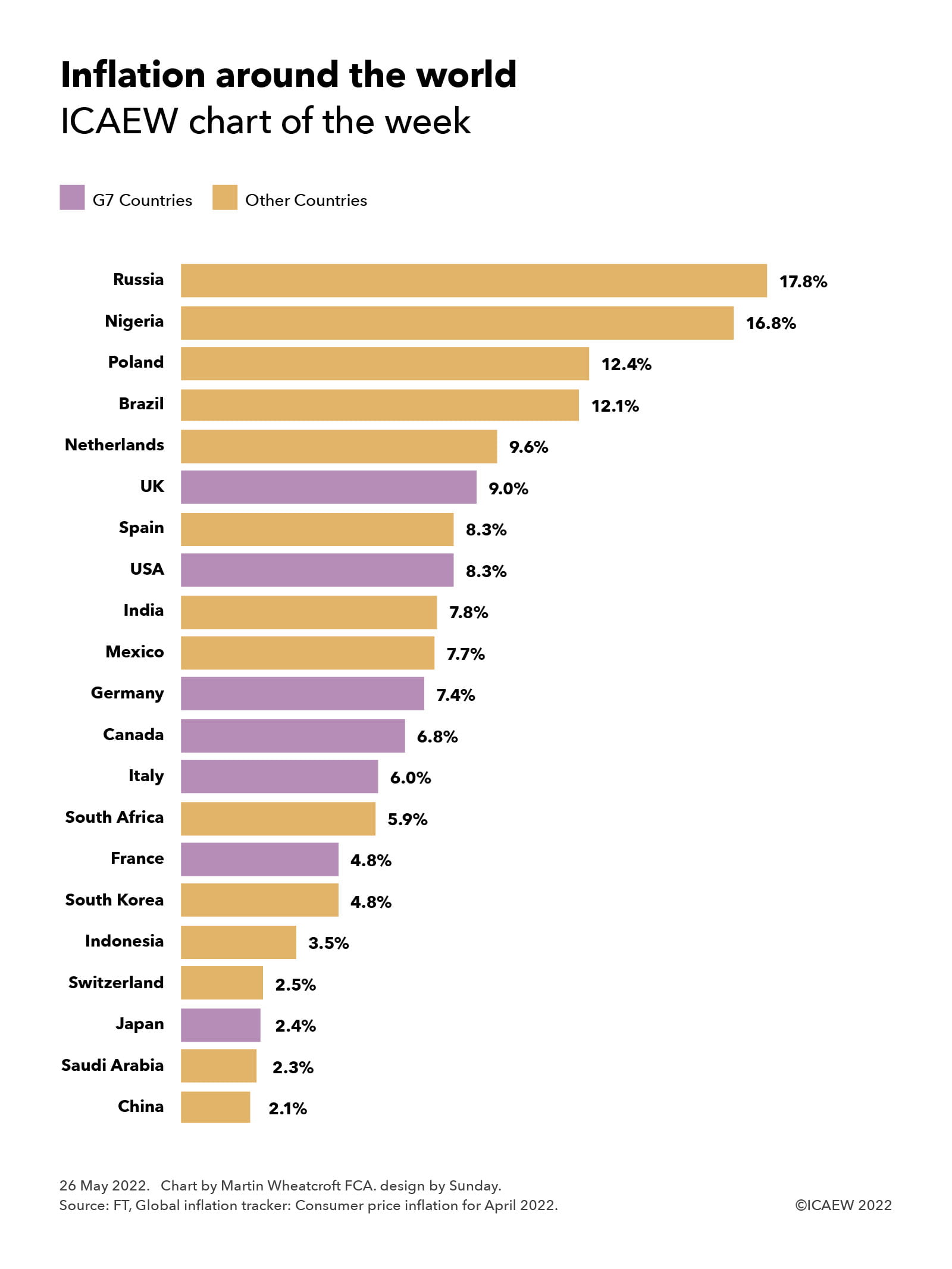

- Monitoring key economic indicators and inflation trends is essential for understanding the current economic climate.

- Both fiscal and monetary policies play a significant role in managing and influencing inflation rates.

Understanding the Demand-Pull Inflation Trends

Demand-pull inflation occurs when there is an increase in aggregate demand for goods and services that outpaces the available supply. Several factors can contribute to this surge in demand. Firstly, increased consumer confidence, often fueled by rising wages or asset values, can lead to higher spending. Secondly, government stimulus packages, designed to boost economic activity, can inject significant amounts of money into the economy, further driving demand. Finally, expansionary monetary policy, such as lower interest rates, makes borrowing cheaper, encouraging businesses and individuals to spend more.

When demand exceeds supply, businesses can raise prices because consumers are willing to pay more to obtain the limited goods and services available. This creates a self-perpetuating cycle where rising prices lead to higher wage demands, further fueling inflation. Imagine a scenario where a highly anticipated new gb gaming console launches. If demand far exceeds the number of consoles available, retailers will likely raise the price, and consumers eager to own the console will be willing to pay it. This is a simplified example of demand-pull inflation in action.

Exploring the Cost-Push Inflation Trends

Unlike demand-pull inflation, cost-push inflation arises from increases in the costs of production for businesses. These costs can include raw materials, labor, energy, and transportation. When these costs rise, businesses often pass them on to consumers in the form of higher prices.

One of the most significant drivers of cost-push inflation is supply chain disruptions. For example, if a natural disaster disrupts the production of a key component used in manufacturing, the price of that component will likely increase. This, in turn, will raise the cost of producing goods that use that component, leading to higher prices for consumers. Similarly, rising wages, particularly if they outpace productivity growth, can also contribute to cost-push inflation. The increase in energy prices due to geopolitical events is another example. Higher energy costs affect everything from transportation to manufacturing, pushing up prices across the board and impacting inflation trends.

The Role of Monetary Policy in Managing Inflation Trends

Monetary policy, primarily implemented by central banks, plays a crucial role in managing inflation. Central banks use various tools to influence the money supply and credit conditions in the economy. One of the most important tools is adjusting interest rates. Raising interest rates makes borrowing more expensive, which tends to cool down economic activity and reduce demand-pull inflation. Conversely, lowering interest rates encourages borrowing and spending, which can stimulate economic growth but also potentially contribute to inflation.

Another tool used by central banks is quantitative easing (QE), which involves injecting money into the economy by purchasing assets. QE can help to lower interest rates and increase liquidity, but it can also lead to inflation if it results in too much money chasing too few goods. The effectiveness of monetary policy in managing inflation depends on various factors, including the credibility of the central bank, the responsiveness of businesses and consumers to interest rate changes, and the state of the global economy.

Fiscal Policy and its Impact on Inflation Trends

Fiscal policy, which involves government spending and taxation, also has a significant impact on inflation. Government spending can directly increase aggregate demand, particularly if it is directed towards infrastructure projects or other initiatives that create jobs and stimulate economic activity. Tax policies can also influence inflation by affecting consumer spending and business investment. For example, tax cuts can increase disposable income, leading to higher consumer spending and potentially contributing to demand-pull inflation.

Government deficits, which occur when government spending exceeds tax revenue, can also contribute to inflation. When the government borrows money to finance its deficits, it can increase the demand for credit, potentially pushing up interest rates and crowding out private investment. Additionally, government regulations can also affect inflation by increasing the cost of doing business. For example, environmental regulations can increase the cost of energy, which can then be passed on to consumers in the form of higher prices. Understanding how fiscal policy interacts with inflation trends is essential for evaluating the overall economic outlook.